Get in touch

555-555-5555

mymail@mailservice.com

Weekly Newsletter – August 7, 2017

Weekly Review

Although the stock market once again ended the week in a “mixed” fashion, the Dow Jones Industrial Average continued its march higher by setting consecutive new all-time highs during the week.

In fact, the Dow has set new all-time highs during each of the last eight trading days while crossing another 1,000 point milestone at 22,000 to close the week at 22,092.81. Bond prices also gained some ground to send Treasury yields marginally lower.

The financial markets continue to be buoyed by mostly favorable economic data. This past week

Personal Income was reported unchanged at 0.0% for July versus a consensus forecast of a 0.3% increase, while Personal (consumer) Spending ticked higher by 0.1% in June after an upwardly revised 0.2% gain in May.

On the inflation front, the Core Personal Consumption Expenditures (PCE) Price Index, which excludes food and energy, increased by 0.1% in June to match expectations while the 12-month reading recorded a 1.5% increase.

Although the July ADP Employment data was weaker than expected with a reading of 178,000 new jobs created compared to 187,000 predicted by economists, the Employment Situation Summary (Jobs Report) for July was better than economic forecasts.

The Labor Department reported Non-farm Payrolls at 209,000, which was higher than the 181,000 expected. The Unemployment Rate fell back to 4.3% from June’s reading of 4.4% to matching the reading for May, its lowest rate in 16 years.

Average Hourly Earnings rose 0.3% or by 9 cents to $26.36 to match the consensus forecast and is now up by 2.5% on the year. Overall, both stock and bond participants liked what they saw in the jobs data with the strong job creation while wage inflation remained restrained.

The jobs data resulted in a slight increase in rate hike expectations for the Fed’s December FOMC meeting with the fed funds futures market now showing a 48.0% likelihood of a rate hike in December. This is up from last Thursday’s closing reading of 46.8%.

In housing, the National Association of Realtors (NAR) reported their Pending Home Sales Index (PHSI) snapped a three month losing streak by posting a 1.5% gain in June to reach a reading of 110.2, up from May’s level of 108.6.

Lawrence Yun, chief NAR economist, remarked “The first half of 2017 ended with a nearly identical number of contract signings as one year ago, even as the economy added 2.2 million net new jobs. “Market conditions in many areas continue to be fast-paced, with few properties to choose from, which are forcing buyers to act almost immediately on an available home that fits their criteria.

Low supply is an ongoing issue holding back activity. Housing inventory declined last month and is a staggering 7.1% lower than a year ago. It appears the ongoing run-up in price growth in many areas and less homes for sale at bargain prices are forcing some investors to step away from the market.

Fewer investors paying in cash is good news as it could mean a little less competition for the homes first-time buyers can afford.”

Mortgage application volume decreased during the week ending July 28. The Mortgage Bankers Association (MBA) reported their overall seasonally adjusted Market Composite Index (application volume) fell 2.8%. The seasonally adjusted Purchase Index fell 2.0% from the prior week while the Refinance Index decreased 4%.

Overall, the refinance portion of mortgage activity decreased to 45.5% of total applications from 46.0% in the prior week. The adjustable-rate mortgage share of activity decreased to 6.6% of total applications from 6.8%.

According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance were unchanged at 4.17% with points decreasing to 0.36 from 0.40.

For the week, the FNMA 3.5% coupon bond gained 25.0 basis points to close at $103.17. The 10-year Treasury yield decreased 2.69 basis points to end at 2.2637%. Stocks ended the week mixed with the NASDAQ Composite Index edging lower while the S&P 500 Index and Dow Jones Industrial Average moved higher.

The Dow Jones Industrial Average gained 262.50 points to close at 22,092.81. The NASDAQ Composite Index fell 23.12 points to close at 6,351.56 and the S&P 500 Index added 4.73 points to close at 2,476.83.

Year to date on a total return basis, the Dow Jones Industrial Average has gained 11.96%, the NASDAQ Composite Index has advanced 19.13%, and the S&P 500 Index has risen 11.67%.

This past week, the national average 30-year mortgage rate fell to 3.99% from 4.04%; the 15-year mortgage rate decreased to 3.29% from 3.33%; the 5/1 ARM mortgage rate increased to 3.18% from 3.17%; and the FHA 30-year rate fell to 3.65% from 3.75%. Jumbo 30-year rates decreased to 4.28% from 4.33%.

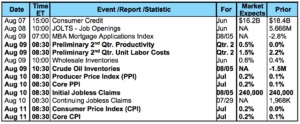

Economic Calendar – for the Week of August 8, 2017

Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

Mortgage Rate Forecast with Chart – FNMA 30-Year 3.5% Coupon Bond

The FNMA 30-year 3.5% coupon bond ($103.17, +25.0 bp) traded within a 51.5 basis point range between a weekly intraday low of $102.81 on Tuesday and a weekly intraday high of $103.328 on Thursday before closing the week higher at $103.17 on Friday.

Bond prices ended notably higher on Tuesday and Thursday before giving back some of the gains on Friday in reaction to the Jobs Report. Still, the bond was able to break above a couple of resistance levels before falling back below resistance at the $103.20 level on Friday. Friday’s reactionary trading resulted in a Hanging Man candlestick.

The Hanging Man is a bearish signal appearing in an uptrend and is a warning of a potential trend reversal lower. However, the long lower shadow or wick of the Hanging Man is also a potentially a bullish signal, indicating that demand for the bond forced the price into the upper third of the price range for the day.

Therefore, confirmation of a trend reversal should be watched for. Confirmation would be Monday’s candlestick closing below the real body of Friday’s Hanging Man candlestick.

Also, the bond is showing a sell signal from a negative stochastic crossover while extremely “overbought.” This suggests the next move is lower toward support, and we could see a slight deterioration in mortgage rates this coming week.

The post Weekly Newsletter – August 7, 2017 appeared first on Owings Mills & Lutherville Mortgage.

© 2024 NEO Home Loans

For licensing information, go to: www.nmlsconsumeraccess.org | www.goluminate.com | Please review our Disclosures & Licensing information. | Luminate Home Loans, Inc. is a wholly-owned subsidiary of Luminate Bank. Equal Housing Lender. For further information about Luminate Home Loans, Inc., please visit our website at www.goluminate.com. Luminate Home Loans, Inc. NMLS#150953.

Corporate Headquarters: 2523 Wayzata Blvd. S. Suite 200, Minneapolis, MN 55405

Do Not Sell My Personal Information Privacy Policy | Disclosure & Licensing