The Cost of Waiting to Buy

Think waiting will save you money? Here's why it might cost you more in the long run.

When it comes to investments, many people say it’s all about timing. While that’s good advice in theory, there’s simply no way to time the housing market. In a perfect world, interest rates and prices would both be low—and this does happen, but not very frequently.

At current home prices and mortgage rates, the cost of purchasing a home can feel very high. But as home prices rise, the cost of waiting is even higher!

That is why I am so excited to be able to offer my clients a personal Cost of Waiting analysis for your area. This report can help you understand how appreciation, amortization, and payments are affected by delaying a home purchase.

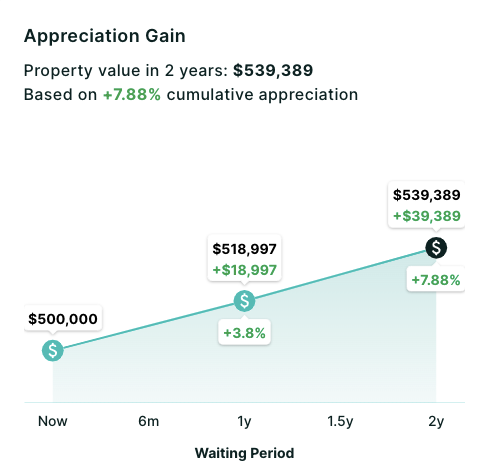

Appreciation Gain

The average annual appreciation of real estate is between 3% and 5%, but it can vary widely depending on location, property type, and market conditions. As an example, let’s take a look at the cost of waiting to buy a home in Bel Air, Maryland.

With an estimated appreciation gain of 3.8% every year, the cost of a $500,000 house will increase to $539,389 within two years. To put it plain and simple: the cost of waiting for the “right time” to buy is nearly 40K.

Increased Loan Amount

As a result of rising property values, your down payment and loan will also continue to rise the longer you wait.

If you were to purchase a $500,000 home today, with a down payment of $50,000, your loan amount would be $450,000. But, if you were to wait another year to close, that same property would increase in value to $518,997. That would result in needing $51,900 as your down payment, with a total loan amount of $467,097.

While the increase between those numbers might not seem a tremendous amount, the increased loan amount can greatly expand your monthly mortgage.

Of course, there are legit reasons to delay a home purchase—it is a big financial decision. If you need to work on your credit, save for a down payment, or establish an emergency fund, then waiting sounds like a great move. However, if you’re drumming your fingers just waiting for the ideal housing market, then you might want to understand the true cost of waiting.

If you would like a Cost of Waiting analysis, or would like to start your home-buying journey today, don't hesitate to reach out!